Some Of Offshore Company Formation

Table of ContentsWhat Does Offshore Company Formation Mean?The smart Trick of Offshore Company Formation That Nobody is DiscussingThe Ultimate Guide To Offshore Company FormationOffshore Company Formation Can Be Fun For Everyone

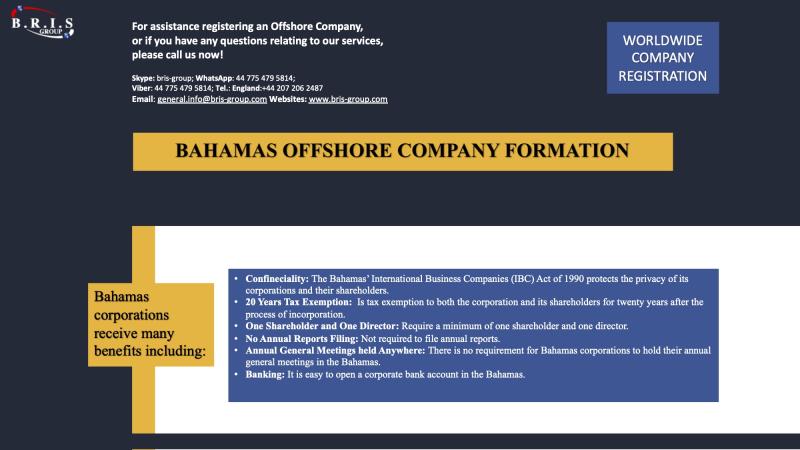

Hong Kong allows creation of overseas firms and also offshore savings account if your company does not sell Hong Kong region. In this situation, there will be no business tax obligation applied on your revenues. Offshore business in Hong Kong are attractive: stable jurisdiction with excellent reputation and also a dependable overseas financial system.Although there are no clear distinctions as a result of the individual business regulations of each country, typically the major differences are tax framework, the degree of privacy as well as asset security. Numerous nations desire to bring in foreign business and also investors by presenting tax regulations pleasant to non-residents and also international firms. Delaware in the USA for instance is historically one of the most significant tax sanctuaries in the globe.

Offshore tax obligation sanctuaries are frequently identified as a means for tax obligation evasion. This is often due to their strict secrecy as well as possession security legislations as they are not bound to report or disclose any kind of details to your nation of house. However, that does not indicate you do not have to comply with legislations where you are resident in regards to monetary reporting responsibilities.

Unknown Facts About Offshore Company Formation

The term offshore refers to the company not being resident where it is officially included. In addition, usually greater than not, the directors as well as other participants of an offshore company are non-resident additionally adding to the firm not being resident in the nation of registration. The term "offshore" may be a little bit confusing, due to the fact that several contemporary economic centres in Europe, such as Luxembourg, Cyprus as well as Malta offer global service entities the same benefits to non-resident firms as the conventional Caribbean "tax sanctuaries", but frequently do not make use of the term offshore.

Nonetheless, that does not suggest you do not need to follow laws where you are resident in regards to economic reporting responsibilities. The discretion by having an overseas company is not regarding concealing assets from the government, yet concerning privacy and protection from unwarranted suits, dangers, partners and also various other lawful disputes.

The term offshore and confusion bordering such firms are commonly linked with outrages. Nonetheless, overseas business act like any normal company but are held check this in different jurisdictions for tax purposes thus giving it benefits. This does not suggest it acts prohibited, it's just a means to optimise a business for tax and security purposes.

The Main Principles Of Offshore Company Formation

These are frequently limiting demands, high expenses as well as disclosure plans. Although any person can begin a company, not every can obtain the exact same benefits. The most usual advantages you will certainly locate are: Easy of registration, Marginal fees, Adaptable management as well as minimal reporting needs, No forex limitations, Good regional company legislation, High privacy, Tax obligation benefits, Marginal or no limitations in relation to business activities, Moving opportunities Although it really depends upon the laws of your nation of residence as well as just how you desire to optimise your company, normally on-line companies as well as anything that is not reliant on physical infrastructure commonly has the best advantages.

Tasks such as the below are one of the most common as well as helpful for overseas enrollment: Offshore financial savings and also investments Forex and stock trading, Ecommerce Expert solution business Net solutions International based company, Digital-based Company, Global trading Possession of copyright Your nation of house will my latest blog post inevitably specify if you can come to be entirely tax-free or otherwise (offshore company formation).

This list is not extensive and also does not necessarily use to all jurisdictions, these are generally sent off to the enrollment office where you want to sign up the company.

is an enterprise which only carries out economic tasks outside the nation in which it is signed up. An overseas business can be any enterprise which doesn't run "at residence". At the very same time, according to popular opinion, an overseas company is any venture which enjoys in the nation of registration (offshore company formation).

The Basic Principles Of Offshore Company Formation

Setting up an overseas company appears complex, yet it worth the effort. An usual reason to establish an overseas business is to fulfill the legal needs of the nation where you wish to acquire residential property. There are numerous offshore territories. We constantly seek to discover. They all satisfy the really high standards of, which are essential components in choosing your offshore place.

Since privacy is just one of the most crucial facets of our work, all details gone into on this form will certainly be kept purely private (offshore company formation).

Even prior to going into details on just how an offshore company is developed, we initially need to comprehend what an overseas firm really is. This is a service entity that is formed and runs outside your nation of home. The term 'offshore' in finance refers to industrial methods that are located outside the owner's national limits.